Hensoldt AG: Financial Performance, Strategic Outlook, and Competitive Analysis

1. Executive Summary:

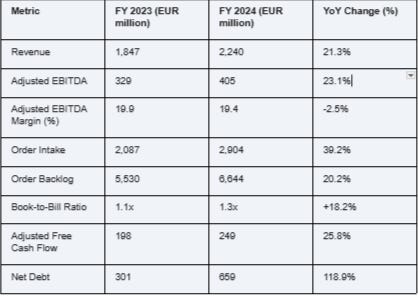

Hensoldt AG, a prominent European defense electronics company, demonstrated exceptional financial performance in the fiscal year 2024. The company achieved record levels of order intake and backlog, significantly surpassing its own expectations and underscoring the robust demand for its sophisticated defense and security solutions 1. Order intake reached EUR 2,904 million, marking an impressive 39% increase compared to the previous year, while the order backlog soared to a record EUR 6,644 million, a substantial 20% rise 1. This remarkable surge in orders translated into strong revenue growth, with revenues increasing by 21.3% to EUR 2,240 million 1. The company also exhibited strong profitability, with adjusted EBITDA growing by 23% to EUR 405 million, and the adjusted EBITDA margin (excluding pass-through business) exceeding its own guidance at 19.4% 1. Furthermore, Hensoldt generated significant cash flow, with adjusted free cash flow increasing by 26% to EUR 249 million 1. This overachievement against its financial targets for FY 2024 1 highlights the company's reliability and strong operational execution. Looking ahead, Hensoldt anticipates continued positive business development, projecting revenue growth to EUR 2.5-2.6 billion in FY 2025 and an adjusted EBITDA margin of around 18% 1. The company successfully completed the integration of the ESG Group, further enhancing its capabilities 1. Reflecting its strong financial standing and confidence in future performance, Hensoldt has proposed a substantial 25% increase in its dividend to EUR 0.50 per share 1. In the competitive landscape, Hensoldt operates alongside major defense players such as Lockheed Martin, BAE Systems, and Thales 5.

The consistent pattern of Hensoldt surpassing its financial expectations in FY 2024 1 suggests a robust and potentially underestimated underlying strength in its business operations. This tendency to exceed its own forecasts could indicate a prudent management approach, setting achievable targets and then outperforming them. Such consistent over-delivery often fosters greater confidence among investors and stakeholders regarding the company's future prospects. The substantial growth in the order backlog 1 provides a considerable degree of certainty regarding the company's revenue generation in the coming years. With the backlog representing approximately three years of current revenue, Hensoldt has a significant buffer against potential economic uncertainties or delays in specific projects. This strong backlog not only secures future income but also provides the company with greater flexibility in its strategic planning and resource allocation. Furthermore, the decision to propose a significant increase in the dividend payout 1 serves as a strong indicator of management's positive outlook on the company's future profitability and its ability to generate consistent cash flows. This increased return of capital to shareholders can enhance the attractiveness of the stock, particularly to investors seeking regular income, and generally reflects a healthy and financially sound organization.

2. Hensoldt AG: Company Profile and Market Position:

Headquartered in Taufkirchen near Munich, Germany, Hensoldt AG stands as a leading entity within the European defense industry, extending its reach globally through its advanced sensor solutions 1. The company specializes in the development and integration of cutting-edge sensor technologies tailored for a wide spectrum of defense and security applications 1. Its offerings include platform-independent, networked sensors, positioning Hensoldt as a key system integrator in the defense sector 1. Originating as a division of the Airbus Group, Hensoldt possesses a strong foundation rooted in aerospace and defense technologies, which it now leverages as an independent, publicly listed company 9. The company's expertise lies particularly in sensor technology critical for reconnaissance and surveillance operations, essential components of modern military strategies 9. Beyond its core defense focus, Hensoldt actively pursues opportunities in commercial applications, demonstrating a commitment to diversifying its revenue streams and leveraging its technological advancements in broader markets 9. Recognized for its significance in the German stock market, Hensoldt is included in both the MDAX and TecDAX indices, reflecting its strong market capitalization and importance within the mid-cap and technology sectors of Germany 1.

Hensoldt's prominent position as a European leader in defense electronics 1 coincides with a period of heightened global geopolitical tensions 5. This environment of increased instability is driving higher defense spending across Europe and globally, creating a favorable market for companies like Hensoldt that provide critical defense technologies. The ongoing conflict in Ukraine, for example, has starkly illustrated the critical need for advanced reconnaissance and surveillance capabilities, areas in which Hensoldt specializes. This external context provides a substantial tailwind for the company's growth prospects. The company's strategic emphasis on sensor solutions 1 aligns perfectly with the evolving nature of modern warfare, where achieving information superiority is paramount across all operational domains 3. By focusing on this specialized area, Hensoldt can cultivate deep technological expertise and potentially establish itself as a leader in niche segments of the defense electronics market. This specialization allows for the development of highly advanced and effective products that meet the specific demands of contemporary military operations. The company's proactive exploration of commercial applications for its technologies 9 indicates a strategic vision aimed at reducing its dependence solely on government defense budgets. By identifying and pursuing civilian uses for its sensor technologies, Hensoldt can tap into new markets and create more diversified and stable revenue streams, enhancing its long-term resilience and growth potential.

3. Recent Performance and Key Updates (Fiscal Year 2024):

3.1. Record Order Intake and Backlog Analysis:

Hensoldt AG achieved unprecedented levels of order intake and backlog in FY 2024. The company secured orders amounting to EUR 2,904 million, representing a substantial 39% increase compared to the EUR 2,087 million recorded in the previous fiscal year 1. This significant surge in demand propelled the company's order backlog to a record high of EUR 6,644 million, a 20% increase from the EUR 5,530 million reported in FY 2023 1. The book-to-bill ratio, a key indicator of future revenue growth, improved to 1.3x in FY 2024 from 1.1x in the preceding year 1. Furthermore, the company experienced continued strong order momentum in the later part of 2024 and the beginning of 2025, with order intake exceeding EUR 1.4 billion between October 2024 and January 2025 1.

The remarkable increase in order intake 1 strongly suggests a combination of heightened market demand, likely fueled by the current geopolitical climate, and Hensoldt's success in securing significant new contracts. This substantial growth, outpacing the company's revenue growth, lays a solid foundation for future revenue expansion. The improved book-to-bill ratio of 1.3x 1 signifies that Hensoldt is generating 1.3 euros of new orders for every euro of revenue it recognizes. This ratio above 1 indicates a growing company with strong market traction. The sustained strength in order intake observed in the latter part of 2024 and the early months of 2025 1 suggests that the positive trends driving demand for Hensoldt's solutions are persistent and are likely to continue to support the company's growth trajectory in the near term.3.2. Revenue Growth Drivers and Performance Breakdown:

In FY 2024, Hensoldt AG achieved a significant 21.3% increase in revenue, reaching EUR 2,240 million compared to EUR 1,847 million in FY 2023 1. Adjusting for the business activities of the recently integrated ESG Group, the core business of Hensoldt experienced a growth rate of approximately 9% 1. Notably, the company continued its strategic effort to reduce its involvement in pass-through business, which declined by 22%, thereby enhancing the overall quality of its revenue 3.

The impressive revenue growth in FY 2024 1 was driven by a combination of organic expansion in Hensoldt's core operations and the contribution from the newly acquired ESG Group. The fact that the core business still achieved a robust 9% growth rate after accounting for ESG 1 demonstrates the underlying strength and increasing market penetration of Hensoldt's traditional product lines. The deliberate reduction in pass-through business 1 reflects a strategic focus on higher-margin activities that provide greater value to the company. This shift towards higher-quality revenue is expected to have a positive impact on Hensoldt's long-term profitability and sustainability.3.3. Profitability Analysis: EBITDA and Margin Improvements:

Hensoldt AG demonstrated significant improvements in profitability during FY 2024. The company's adjusted EBITDA totaled EUR 405 million, a substantial increase from the EUR 329 million reported in FY 2023 1. Furthermore, the adjusted EBITDA margin, when excluding pass-through business, exceeded the company's own expectations, reaching 19.4% compared to the guidance range of 18-19% 1.

The considerable growth in adjusted EBITDA 1 indicates enhanced operational efficiency and potentially improved pricing power within the market. This increase in profitability outpaced the revenue growth, suggesting that Hensoldt effectively managed its costs and leveraged its scale. The fact that the adjusted EBITDA margin surpassed the company's own forecast 1 underscores the strength of its core defense electronics business model and its ability to generate strong returns from its operations. This improved profitability provides Hensoldt with greater financial flexibility to reinvest in the business, pursue strategic acquisitions, and potentially increase returns to shareholders.3.4. Cash Flow Generation and Financial Health:

Hensoldt AG exhibited strong cash flow generation in FY 2024, with adjusted free cash flow growing by 26% to EUR 249 million, up from EUR 198 million in the previous year 1. The company's net debt, excluding the impact of the capital increase and pension liabilities, increased to EUR 659 million compared to EUR 301 million in FY 2023 2. However, Hensoldt successfully deleveraged its balance sheet ahead of its own guidance, achieving a net leverage ratio of 1.6 times by the end of 2024 3.

The robust growth in adjusted free cash flow 1 highlights Hensoldt's strong ability to generate cash from its core business operations after accounting for capital expenditures. This healthy cash flow provides the company with significant financial flexibility to fund future growth initiatives, repay debt, and return capital to shareholders. While the net debt increased during the year, likely due to the acquisition of ESG, the fact that Hensoldt was able to reduce its net leverage ratio to 1.6 times by the end of 2024 3 demonstrates effective debt management and a commitment to maintaining a healthy capital structure. This deleveraging ahead of schedule indicates a positive trend in the company's financial health and its ability to manage its debt obligations.3.5. Integration of ESG Group: Impact and Synergies:

Hensoldt AG successfully completed the integration of the ESG (Electronic Service Group) within a relatively short timeframe of nine months 1. As planned, ESG contributed EUR 289 million in sales during FY 2024 3. The operations of ESG have been integrated into Hensoldt's Multi-Domain Solutions division 3, strategically aligning with the company's focus on this growing area of defense. Furthermore, Hensoldt and QinetiQ Germany have expanded their cooperation in the field of uncrewed aerial vehicles and systems, with ESG serving as the prime contractor in this collaboration 2.

The swift and successful integration of ESG 1 demonstrates Hensoldt's effective acquisition strategy and its ability to efficiently incorporate new businesses into its existing structure. The fact that ESG's sales performance met expectations during the integration period indicates a smooth transition and the potential for realizing anticipated synergies. The strategic move to integrate ESG into the Multi-Domain Solutions division 3 underscores Hensoldt's commitment to strengthening its presence and capabilities in this increasingly important segment of the defense market. The expanded partnership with QinetiQ Germany 2, with ESG playing a central role, highlights the strategic benefits of the acquisition, enabling Hensoldt to offer more comprehensive and integrated solutions in the area of uncrewed aerial systems, potentially leading to new business opportunities and enhanced market reach.3.6. Dividend Proposal and Shareholder Returns:

For FY 2024, Hensoldt AG has proposed a dividend of EUR 0.50 per share, representing a significant 25% increase from the EUR 0.40 per share paid in FY 2023 1. The company has also set a medium-term target dividend payout ratio of 30% to 40% of its adjusted net income 3.

The substantial increase in the proposed dividend 1 is a clear indication of Hensoldt's strong financial performance in FY 2024 and reflects the management's confidence in the company's future earnings potential. This increased return of capital to shareholders is a positive signal for investors and demonstrates the company's commitment to delivering shareholder value. The establishment of a medium-term dividend payout ratio target 3 provides investors with greater clarity regarding the company's capital allocation strategy and its intention to continue sharing its profitability with its shareholders in a consistent manner.3.7. Significant Contract Wins and Developments:

During FY 2024 and the early part of 2025, Hensoldt AG secured several significant contract wins and achieved notable project developments. In the Sensors segment, the company received large orders for TRML-4D radars, the LVS NNbS air defense system, Spexer radars, and additional TRS-4D radars for the German Navy's F126 class frigates 2. The Optronics segment experienced a significant increase in order intake due to orders related to the Leopard 2 platform, modernization of sensors for Fennek reconnaissance vehicles, and periscopes and optronic mast systems for U212 class submarines 2. Furthermore, a major contract extension for the ECRS Mk1 project (Eurofighter Common Radar System Mark 1) was booked in January 2025 2. Hensoldt also successfully completed the critical design review for the PEGASUS project in autumn 13, and the modified Pegasus aircraft completed its first flight 3. Additionally, the company delivered a weapon optronic sensor to KNDS 3.

The diverse range of substantial contract wins 2 across various product segments underscores the breadth and depth of Hensoldt's technological capabilities and its strong relationships with key defense customers. These contracts provide significant revenue visibility and demonstrate the continued demand for the company's advanced defense solutions. The progress achieved on critical projects such as the ECRS Mk1 radar for the Eurofighter and the PEGASUS project 2 highlights Hensoldt's technical expertise and its ability to successfully execute complex defense programs. These achievements are crucial for maintaining the company's reputation as a reliable and innovative partner in the defense industry and for securing future contracts.

4. Future Plans and Strategic Outlook:

4.1. 2025 Financial Guidance and Targets:

Looking ahead to the fiscal year 2025, Hensoldt AG anticipates continued positive business development. The company expects to achieve revenue in the range of EUR 2,500 to 2,600 million, representing further growth from the EUR 2,240 million reported in 2024 1. The book-to-bill ratio is projected to be around 1.2x, slightly lower than the 1.3x achieved in 2024 1. In terms of profitability, Hensoldt anticipates an adjusted EBITDA margin of approximately 18% 1. The company also expects a cash conversion rate of 50% to 60% for its adjusted free cash flow 3 and aims to further reduce its net leverage to around 1.5 times by the end of 2025 3.

The projected revenue growth for 2025 1 indicates that Hensoldt expects to build upon its strong performance in 2024, although the growth rate may moderate slightly. This continued growth is likely supported by the company's substantial order backlog. The anticipated book-to-bill ratio of around 1.2x for 2025 1, while slightly lower than the previous year, still suggests that Hensoldt expects to secure new orders at a rate that exceeds its revenue recognition, indicating continued growth in the order backlog. The projected adjusted EBITDA margin of around 18% for 2025 1 is a slight decrease from the 19.4% achieved in 2024. This could be attributed to planned investments in strategic initiatives or a normalization of certain factors that contributed to the higher margin in the previous year. The focus on maintaining a strong cash conversion rate and further reducing net leverage 3 underscores Hensoldt's commitment to financial discipline and strengthening its balance sheet.4.2. Medium-Term Growth Strategy ("North Star" initiatives):

Hensoldt AG has set an ambitious target to reach EUR 5 billion in revenue by the year 2030 2. The company's medium-term growth strategy, known as "North Star," is centered around four key pillars: focused growth, delivering at scale, pioneering software-defined defense, and leading with their team 3. As part of this strategy, Hensoldt expects to achieve an average annual organic revenue growth rate of 10% 3 and aims for an adjusted EBITDA margin of around 19% 3 with an average adjusted free cash flow conversion rate of 50% to 60% 3.

The long-term revenue target of EUR 5 billion by 2030 2 demonstrates Hensoldt's significant growth aspirations and implies a need for continued strong performance in both securing new business and efficiently executing its existing backlog. The four pillars of the "North Star" strategy 3 provide a clear framework for achieving this growth. "Focused growth" likely refers to strategic market selection and product development, while "delivering at scale" emphasizes the need for efficient production and operational capabilities to meet increasing demand. The focus on "pioneering software-defined defense" highlights the company's recognition of the growing importance of software in modern defense systems and its ambition to be a leader in this area. Finally, "leading with their team" underscores the importance of talent and organizational capabilities in achieving these ambitious goals. The expected average annual organic revenue growth of 10% 3 suggests a strong emphasis on expanding the core business through market share gains and innovation, while the targeted EBITDA margin and free cash flow conversion rates indicate a focus on maintaining strong profitability and cash generation as the company grows.4.3. Focus on Digitalization and Software-Defined Defense:

Digitalization is a central priority for Hensoldt AG, with a clear roadmap in place to transform the company into a truly digital enterprise 3. A key strategic ambition is to be a pioneer in the realm of software-defined defense 3. To this end, Hensoldt has initiated a number of digital initiatives, and its ERP transformation project is progressing as planned 3. The company is also actively investing in the development of new products for space, multi-domain capabilities, and synthetic training environments 16.

Hensoldt's strong emphasis on digitalization and the ambition to lead in software-defined defense 3 reflects a deep understanding of the evolving landscape of the defense industry. Modern military systems are increasingly reliant on sophisticated software for integration, control, and advanced functionalities. By focusing on becoming a digital company and pioneering software-defined defense, Hensoldt aims to develop cutting-edge solutions that meet the future needs of its customers. The ongoing digital initiatives and the on-track ERP transformation 3 are critical steps in building the necessary infrastructure and capabilities to support this strategic direction. Furthermore, the investments in areas like space, multi-domain capabilities, and synthetic training 16 align with the trend towards more integrated and technologically advanced defense solutions, positioning Hensoldt to capitalize on these emerging opportunities.4.4. Capacity Expansion and Production Investments:

Hensoldt AG is actively pursuing capacity expansion initiatives to meet the growing demand for its products 1. This includes a significant investment in a new radar anechoic chamber at its Ulm site, which will expand the company's radar production capabilities 2. Additionally, a new 30,000 square meter logistics center in Southern Germany has become operational, centralizing logistics operations and increasing overall production capacity 3. Furthermore, the company's new plant in Oberkochen is preparing to ramp up series production in the Optronics division 13.

These substantial investments in expanding production capacity and logistics infrastructure 1 demonstrate Hensoldt's commitment to scaling its operations to effectively fulfill its growing order backlog and to prepare for anticipated future growth. The new radar anechoic chamber in Ulm will directly enhance the company's ability to produce and test its radar systems, a key product area. The new logistics center will improve efficiency in the supply chain and support higher production volumes. Similarly, the ramp-up of the new plant in Oberkochen will significantly increase Hensoldt's capacity in the Optronics segment. These strategic investments are crucial for ensuring that the company can meet the increasing demand for its products and maintain its position as a reliable supplier in the defense industry.4.5. Internationalization Efforts and Market Expansion:

Hensoldt AG is increasingly focused on internationalization, with these efforts gaining momentum 3. Notably, European partner countries accounted for approximately 40% of the company's order intake in FY 2024 2. The company's strategic focus includes continued growth in its domestic market of Germany, across Europe, and in selected international markets 3. Hensoldt is also actively exploring specific international opportunities, such as a potential land border surveillance system in Algeria 3.

The growing contribution of international markets to Hensoldt's order intake 2 highlights the success of its efforts to expand its reach beyond its domestic base. This international diversification is a key element of the company's growth strategy, allowing it to tap into new markets and reduce its reliance on any single region. The continued focus on Germany and Europe 3 reflects the company's strong existing presence and the opportunities arising from increased defense spending in these regions. The active pursuit of opportunities in selected international markets, such as the potential project in Algeria 3, demonstrates a proactive approach to identifying and securing new business in strategically important areas. This international expansion will be crucial for achieving Hensoldt's ambitious long-term growth targets.4.6. Potential Impact of Increased Defense Spending:

Hensoldt AG benefits from strong political support in its home market of Germany 3. Furthermore, there is a potential for significant increases in defense spending in both Germany and across Europe, including discussions around a new EUR 200 billion special fund in Germany and potential EU considerations regarding the exemption of defense spending from debt ceilings 3. The company anticipates revisiting its financial guidance once there is greater clarity on the magnitude and timing of these potential budget increases 3 and is closely monitoring the formation of the new German government and its potential impact on defense investments 3.

The potential for substantial increases in defense spending in Germany and Europe 3 presents a significant opportunity for Hensoldt AG. As a leading provider of defense electronics in the region, the company is well-positioned to benefit from increased procurement of defense equipment and systems. The German government's strong political support 3 and the potential for a special fund dedicated to defense spending could translate directly into increased demand for Hensoldt's products and services. Similarly, broader increases in European defense budgets would create additional opportunities for the company to expand its market share. Hensoldt's prudent approach of waiting for more clarity on these budget increases before revising its financial guidance 3 reflects a disciplined financial management strategy. The company's close monitoring of the political landscape in Germany 3 indicates an awareness of the potential impact of government decisions on its future business prospects.

5. Detailed Financial Results Analysis:

5.1. In-depth Examination of Key Financial Figures for 2024 (with comparisons to 2023):

The financial performance of Hensoldt AG in FY 2024 demonstrated significant growth across key metrics when compared to FY 2023. Revenue increased from EUR 1,847 million to EUR 2,240 million, representing a robust growth of 21.3%. Adjusted EBITDA saw an even more substantial increase, rising from EUR 329 million to EUR 405 million, a growth of 23.1%. While the reported adjusted EBITDA margin saw a slight decrease from 19.9% to 19.4%, this figure for FY 2024 includes the consolidation of the ESG Group and excludes pass-through business, suggesting underlying profitability remained strong. Order intake experienced a remarkable surge of 39.2%, increasing from EUR 2,087 million to EUR 2,904 million. This strong order intake led to a 20.2% increase in the order backlog, which reached EUR 6,644 million from EUR 5,530 million. The book-to-bill ratio improved significantly from 1.1x to 1.3x, indicating strong future revenue potential. Adjusted free cash flow also saw healthy growth of 25.8%, increasing from EUR 198 million to EUR 249 million. However, net debt increased substantially from EUR 301 million to EUR 659 million, likely due to the acquisition of the ESG Group 1.5.2. Analysis of Revenue by Segment (if data permits):

While the provided information does not offer a detailed breakdown of revenue by segment, it indicates that the core business of Hensoldt experienced a growth of approximately 9% in FY 2024, after adjusting for the contribution of the ESG Group 1. The ESG Group itself contributed EUR 289 million in sales during the year 3. Furthermore, the Sensors segment witnessed large order inflows, and the Optronics segment experienced a significant increase in order intake 2. This suggests that both the traditional business segments of Hensoldt and the newly acquired ESG Group are contributing to the overall revenue growth of the company, with strong demand observed in both the sensor and optronics areas. A more granular analysis would require access to the full financial statements.5.3. Breakdown of Operating Expenses and Profitability Drivers:

The significant increase in adjusted EBITDA in FY 2024 suggests that Hensoldt effectively managed its operating expenses relative to its revenue growth. The company's ongoing digitalization and efficiency initiatives 1 likely played a role in improving its operational leverage. While a detailed breakdown of operating expenses is not available in the provided snippets, the improved profitability indicates that Hensoldt was able to control costs and potentially benefit from economies of scale as its revenue increased. The strategic focus on reducing pass-through business, which typically has lower margins, also likely contributed to the improved EBITDA margin in the core business.5.4. Balance Sheet Highlights: Assets, Liabilities, and Equity:

The most prominent balance sheet highlight from the provided data is the substantial increase in the order backlog to EUR 6,644 million 1. This represents a significant asset for Hensoldt, providing strong visibility into future revenue streams. The increase in net debt to EUR 659 million 2 is another key balance sheet change, likely driven by the financing of the ESG Group acquisition. Despite this increase in debt, the company successfully reduced its net leverage ratio to 1.6x by the end of 2024 3, indicating a focus on managing its liabilities. A comprehensive analysis of Hensoldt's balance sheet would require a review of its full financial statements, including details on its current and non-current assets, other liabilities, and equity structure.5.5. Cash Flow Statement Analysis:

Hensoldt's adjusted free cash flow of EUR 249 million in FY 2024 1 demonstrates its ability to generate significant cash from its operations after accounting for capital expenditures. This represents a healthy 26% increase compared to the previous year, indicating improved cash generation efficiency. While the snippets do not provide a full cash flow statement, the strong free cash flow suggests that Hensoldt has ample resources to fund its future growth initiatives, service its debt obligations, and potentially return further capital to shareholders.Key Table 1: Hensoldt AG Key Financial Metrics Comparison (FY 2023 vs. FY 2024):

6. Competitive Landscape Analysis:

6.1. Identification of Hensoldt AG's Primary Competitors:

Hensoldt AG operates within a dynamic and competitive defense industry. Its primary competitors include major global players such as Lockheed Martin 5, BAE Systems 5, and Thales 5. Additionally, the company faces competition from other significant entities in the defense and security sector, including CACI International, L3Harris Technologies, General Dynamics, Elbit Systems, SICK Sensor Intelligence, Optical Sciences, Excelitas Canada, Anduril, and Serco 5. These competitors vary in size, geographical focus, and the breadth of their product and service offerings.6.2. Brief Profiles of Key Competitors and Their Areas of Overlap and Differentiation:

Lockheed Martin is a global leader in aerospace, defense, and security, offering a vast portfolio encompassing aircraft, missiles, space systems, and advanced technology solutions 6. There is overlap with Hensoldt in areas like electronic warfare and sensor systems, but Lockheed Martin differentiates itself through its sheer scale and the breadth of its offerings across multiple defense domains. BAE Systems is a major international defense, security, and aerospace company providing air, land, and naval systems, as well as cyber security and intelligence services 5. Overlap with Hensoldt exists in electronic warfare, sensors, and avionics, with BAE Systems distinguishing itself through its strong presence in the UK and Australia. Thales is a global technology leader in aerospace, defense, digital identity, and security, offering solutions in avionics, space, defense & security, and cybersecurity 7. Hensoldt competes with Thales in areas like sensors, avionics, and electronic warfare, with Thales standing out due to its strong technological focus and its engagement in both civil and military markets.6.3. Potential Competitive Advantages and Disadvantages for Hensoldt AG:

Hensoldt possesses several potential competitive advantages, including its strong position within the growing European defense market, particularly in Germany 1. The company's specialization in sensor solutions, a critical and increasingly important area of modern defense technology 1, also provides a distinct advantage. The successful integration of the ESG Group has expanded Hensoldt's capabilities, particularly in multi-domain solutions 1. Furthermore, the company's strategic focus on digitalization and software-defined defense aligns with the future trends of the industry 3. However, Hensoldt faces disadvantages due to its smaller scale compared to global giants like Lockheed Martin and BAE Systems, which could limit its ability to compete for very large international contracts 5. The company also operates in a highly competitive environment with well-established players 5.

7. Analyst Sentiment and Market Outlook:

The analyst sentiment surrounding Hensoldt AG appears to be mixed. Recent reports indicate "Sell" ratings from analysts at Jefferies and Kepler Capital, with a price target from Jefferies suggesting a potential downside 32. In contrast, Deutsche Bank has maintained a "Buy" rating on the stock 32. The average price target from analysts, according to TipRanks, is €52.40, which is below the current trading price of around €67-€68, suggesting that some analysts believe the stock may be overvalued at present 10. Despite these concerns, the overall analyst consensus rating for Hensoldt is a "Moderate Buy" based on the views of seven analysts 10. Notably, the US OTC ticker for Hensoldt (HAGHY) has significantly outperformed the S&P 500 over the past year 33, and the stock price has surged, reportedly driven by the revitalization of European defense budgets 5. This suggests that while some analysts have valuation concerns, the broader market sentiment towards Hensoldt is positive, likely fueled by the company's strong performance and the favorable geopolitical environment for defense stocks.

8. Conclusion:

Hensoldt AG has demonstrated a strong financial performance in FY 2024, marked by record order intake and backlog, substantial revenue and profit growth, and healthy cash flow generation. The company has successfully integrated the ESG Group and is strategically focused on digitalization and international expansion. The potential for increased defense spending in Europe presents a significant growth opportunity for Hensoldt. While the competitive landscape is dominated by larger global players, Hensoldt's specialization in sensor solutions and strong position in the European market provide key advantages. Analyst sentiment regarding the stock's current valuation is mixed, but the overall market outlook appears positive, reflecting confidence in the company's long-term prospects within a favorable industry environment. Investors should consider Hensoldt's strong fundamentals and growth potential, while also being aware of the competitive pressures and the varying opinions on its current valuation.

Works cited

1. EQS-News: HENSOLDT achieves record order backlog in financial ..., accessed on March 13, 2025, https://www.investegate.co.uk/announcement/eqs/hensoldt-ag--0a5s/eqs-news-hensoldt-achieves-record-order-back-/8754441

2. Financial year 2024 | HENSOLDT, accessed on March 13, 2025, https://www.hensoldt.net/news/4575/financial-year-2024

3. Hensoldt AG (HAGHY) Q4 2024 Earnings Call Transcript | Seeking ..., accessed on March 13, 2025, https://seekingalpha.com/article/4763485-hensoldt-ag-haghy-q4-2024-earnings-call-transcript

4. Investor Relations | HENSOLDT AG, accessed on March 13, 2025,

https://investors.hensoldt.net/

5. HENSOLDT Company Overview, Contact Details & Competitors - LeadIQ, accessed on March 13, 2025, https://leadiq.com/c/hensoldt/5a7b34af510000d6000a3ee4

6. Top HENSOLDT Competitors and Alternatives | Craft.co, accessed on March 13, 2025, https://craft.co/hensoldt/competitors

7. Hensoldt - Company Profile - Tracxn, accessed on March 13, 2025, https://tracxn.com/d/companies/hensoldt/__SHKcExhfIzfeHEO7n7nkc739fsLnsjEOhWmx_5dnnlY

8. Hensoldt AG Peers & Key Competitors - GlobalData, accessed on March 13, 2025, https://www.globaldata.com/company-profile/hensoldt-ag/competitors/

9. HAG Investor Relations - Hensoldt AG - Alpha Spread, accessed on March 13, 2025, https://www.alphaspread.com/security/xetra/hag/investor-relations

10. HENSOLDT AG (HAG) Stock Price, Quote, News & Analysis - TipRanks.com, accessed on March 13, 2025, https://www.tipranks.com/stocks/de:hag

11. Hensoldt publishes annual report 2023 - Militär Aktuell, accessed on March 13, 2025, https://militaeraktuell.at/en/hensoldt-publishes-annual-report-2023/

12. Annual Report Combined Management Report and Consolidated Financial Statements - Hensoldt, accessed on March 13, 2025, https://annualreport.hensoldt.net/resource/PDF/HENSOLDT_GB_Finance_E_2023.pdf

13. Annual Report 2023 - Lobbyregister, accessed on March 13, 2025, https://www.lobbyregister.bundestag.de/media/b2/c6/385006/Jahresbericht-2023.pdf

14. What We Do - Future Technologies - BAE Systems, accessed on March 13, 2025, https://www.baesystems.com/en/what-we-do/future-technologies

15. Share Information | HENSOLDT AG - Investor Relations, accessed on March 13, 2025, https://investors.hensoldt.net/share

16. BAE Systems 2023 full year results | Newsroom, accessed on March 13, 2025, https://www.baesystems.com/en/article/2023-full-year-results

17. Hensoldt Ag Stock Price Today | ETR: HAGG Live - Investing.com, accessed on March 13, 2025, https://www.investing.com/equities/hensoldt-ag

18. Lockheed Martin Reports Fourth Quarter and Full Year 2023 Financial Results, accessed on March 13, 2025, https://www.prnewswire.com/news-releases/lockheed-martin-reports-fourth-quarter-and-full-year-2023-financial-results-302041229.html

19. Lockheed Martin Reports Fourth Quarter and Full Year 2023 Financial Results, accessed on March 13, 2025, https://investors.lockheedmartin.com/node/50281/pdf

20. Lockheed Martin Reports Fourth Quarter and Full Year 2023 Financial Results - Jan 23, 2024, accessed on March 13, 2025, https://news.lockheedmartin.com/2024-01-23-Lockheed-Martin-Reports-Fourth-Quarter-and-Full-Year-2023-Financial-Results

21. Lockheed Martin Corporation, accessed on March 13, 2025, https://investors.lockheedmartin.com/static-files/6872149e-3b38-4dbf-9ef9-eee86eadae49

22. Lockheed Martin Reports Fourth Quarter and Full Year 2024 Financial Results, accessed on March 13, 2025, https://news.lockheedmartin.com/2025-01-28-Lockheed-Martin-Reports-Fourth-Quarter-and-Full-Year-2024-Financial-Results

23. Annual Report 2023 - BAE Systems, accessed on March 13, 2025, https://annualreport.baesystems.com/2023

24. Annual Report 2024 - BAE Systems, accessed on March 13, 2025,

https://annualreport.baesystems.com/

25. Publication of 2023 Annual Report | Company Announcement - Investegate, accessed on March 13, 2025, https://www.investegate.co.uk/announcement/rns/bae-systems--ba./publication-of-2023-annual-report/8076171

26. Preliminary Results Announcement 2023 - BAE Systems, accessed on March 13, 2025, https://investors.baesystems.com/~/media/Files/B/BAE-Systems-Investor/documents/2023-full-year-results-announcement.pdf

27. Thales reports its 2023 full-year results, accessed on March 13, 2025, https://www.thalesgroup.com/en/group/investors/press_release/thales-reports-its-2023-full-year-results

28. Thales Group - Wikipedia, accessed on March 13, 2025, https://en.wikipedia.org/wiki/Thales_Group

29. Integrated Report 2023-2024 - Thales, accessed on March 13, 2025, https://www2.thalesgroup.com/2024/rapport-integre/index-en.html

30. 2023 Full-Year results | Thales Group, accessed on March 13, 2025, https://www.thalesgroup.com/en/event/2023-full-year-results

31. Who we are | Thales Alenia Space, accessed on March 13, 2025, https://www.thalesaleniaspace.com/en/who-we-are

32. HENSOLDT AG (HAG) Receives a New Rating from a Top Analyst | Markets Insider, accessed on March 13, 2025, https://markets.businessinsider.com/news/stocks/hensoldt-ag-hag-receives-a-new-rating-from-a-top-analyst-1034472488

33. HAGHY (Hensoldt AG) vs S&P 500 Comparison - Alpha Spread, accessed on March 13, 2025, https://www.alphaspread.com/comparison/otc/haghy/vs/indx/gspc